|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

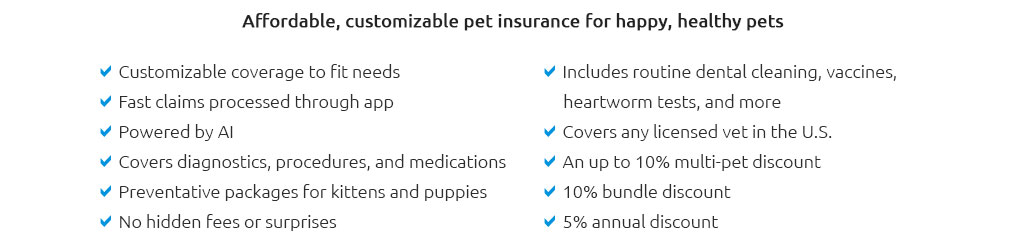

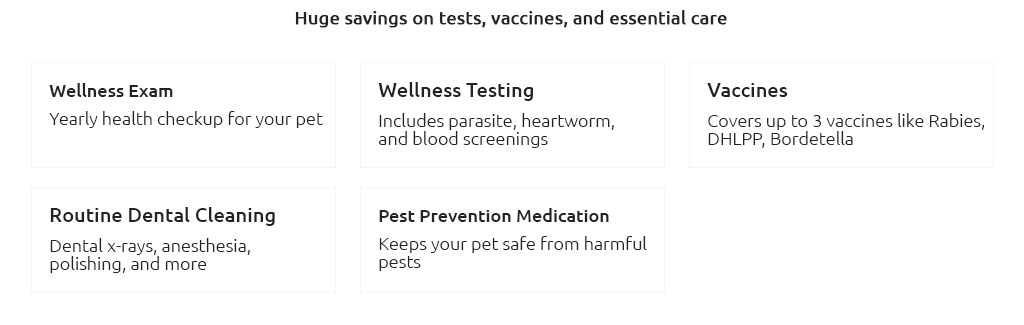

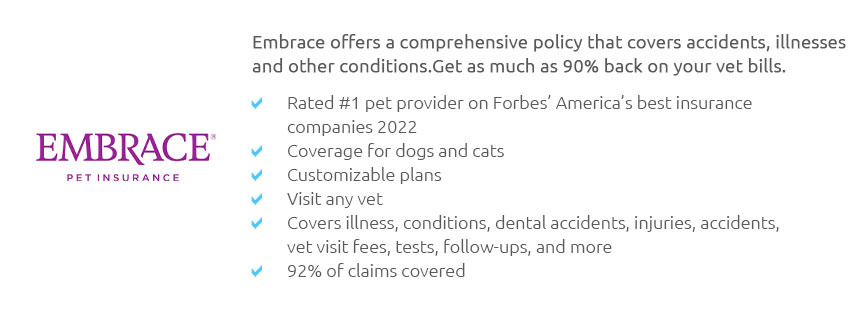

Understanding Pet Insurance Plan CoversIn the realm of pet ownership, the joy and companionship provided by our furry friends are often accompanied by unforeseen health challenges. In recent years, pet insurance has emerged as a pivotal safeguard, offering financial relief to pet owners facing unexpected veterinary costs. However, understanding the intricacies of pet insurance plan covers can be a daunting task, especially with the myriad options available in today's market. In this comprehensive guide, we will delve into the various components of pet insurance plans, offering insights and subtle opinions to help you navigate this essential aspect of responsible pet ownership. First and foremost, it's imperative to comprehend the basic structure of pet insurance policies. Typically, pet insurance plans are categorized into three primary types: accident-only plans, accident and illness plans, and wellness plans. Accident-only plans are the most straightforward, covering veterinary expenses resulting from unexpected injuries such as fractures or lacerations. While these plans offer a safety net for sudden accidents, they do not cover illnesses or routine care, which may be a limitation for some pet owners. Accident and illness plans, on the other hand, provide a broader spectrum of coverage. These plans encompass not only injuries but also a wide range of illnesses, from common ailments like ear infections to more serious conditions such as cancer. It's worth noting that while these plans offer extensive coverage, they often come with higher premiums. Nevertheless, for many pet owners, the peace of mind knowing that both accidents and illnesses are covered is invaluable. For those seeking comprehensive coverage, wellness plans can be an attractive option. These plans typically cover routine care, including vaccinations, dental cleanings, and annual check-ups. While wellness plans often have higher upfront costs, they can lead to significant savings over time, particularly for pets that require regular preventive care. Beyond the basic types of plans, pet insurance policies may also include a variety of optional add-ons, which can enhance coverage but also increase premiums. These add-ons might cover specific needs such as dental treatments, alternative therapies like acupuncture or chiropractic care, and even behavioral therapy. When selecting a plan, it's crucial to carefully evaluate these options in the context of your pet's specific health needs and your financial situation. Another critical aspect to consider is the policy's terms and conditions, particularly regarding exclusions and waiting periods. Most pet insurance plans have a list of exclusions that might include pre-existing conditions, congenital or hereditary disorders, and certain breed-specific issues. Understanding these exclusions is vital to avoid unpleasant surprises when filing a claim. Furthermore, waiting periods are an essential factor to be aware of. These periods refer to the time between the policy start date and when coverage actually begins. Typically, there are different waiting periods for accidents and illnesses, and it's important to be mindful of these timelines to ensure continuous coverage for your pet. In terms of reimbursement, pet insurance plans generally operate on a reimbursement basis, meaning that pet owners pay the veterinary bill upfront and then submit a claim to the insurance provider for reimbursement. It's beneficial to familiarize yourself with the claim process and reimbursement rates, which can vary significantly between providers. Some plans offer a flat percentage of reimbursement, while others may have variable rates based on the type of service rendered. In conclusion, selecting the right pet insurance plan requires a thoughtful assessment of your pet's health needs, your financial considerations, and the specific coverage options available. While the abundance of choices can be overwhelming, taking the time to thoroughly research and compare different plans can lead to substantial long-term benefits. Ultimately, a well-chosen pet insurance plan can provide peace of mind and ensure that you can provide the best possible care for your beloved pet without the burden of unexpected financial strain. Frequently Asked Questions

https://www.progressive.com/pet-insurance/

A deductible and copay are applied to claims. Policyholders have the option of an annual coverage benefit of $5,000, $10,000, or $20,000. You can cancel ... https://www.allstate.com/resources/pet-insurance/what-does-pet-insurance-cover

Pet health insurance helps cover veterinarian bills if your pet has an accidental injury or illness. You may have to pay the vet bills up front, and your ... https://www.geico.com/pet-insurance/

Pet health insurance provides coverage for unforeseen medical expenses such as non-pre-existing illnesses and injuries. This can help make health care for your ...

|